How You Can Bolster Your Claim

Here are a few things you can do to bolster your claim: First, if you have pictures of your car or truck that show it was in good condition, send copies to the adjuster. Second, if you know that your car was in better-than-average condition, go back to the mechanic or dealer who typically serviced your vehicle and see if that person will write a note that you can send to the adjuster, stating that your car or truck was in better-than-average condition. Also, if you had extra features added to your vehicle -- such as higher quality trim or after market modifications -- get the mechanic or dealer to state that in the letter as well. Finally, use the Internet and go look for comparisons of your vehicle's value so that if those values are better than what the adjuster is offering, you can send this information along as well and try to get a better deal.

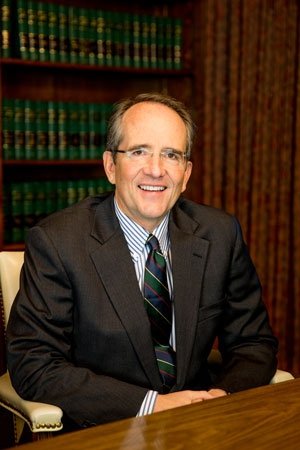

This is an area where a lot of people get upset about what the insurer of the person who hit you (i.e., the at-fault driver) will pay. In most cases, the insurance company is only going to pay the fair market value of your vehicle for the condition that it was in at the time of the crash. So, when the insurance company wants to settle for your vehicle, what do you do? A skilled

This is an area where a lot of people get upset about what the insurer of the person who hit you (i.e., the at-fault driver) will pay. In most cases, the insurance company is only going to pay the fair market value of your vehicle for the condition that it was in at the time of the crash. So, when the insurance company wants to settle for your vehicle, what do you do? A skilled